Financing Your Modular or ADU Project: A Practical Guide for California Homeowners

By Joy Line Homes California

Building a modular home or adding an ADU is one of the smartest investments California homeowners can make today. These projects offer long-term financial and lifestyle benefits — from increased property value to additional rental income. But before breaking ground, it’s essential to understand your financing options and how modular construction fits into the lending process.

Joy Line Homes works with homeowners to make financing clear and approachable. Whether you are purchasing a new modular home or building an ADU in your backyard, there are flexible pathways to make your project a reality. This guide outlines key financing methods and practical steps to help you get started.

Understanding the Cost of Modular and ADU Builds

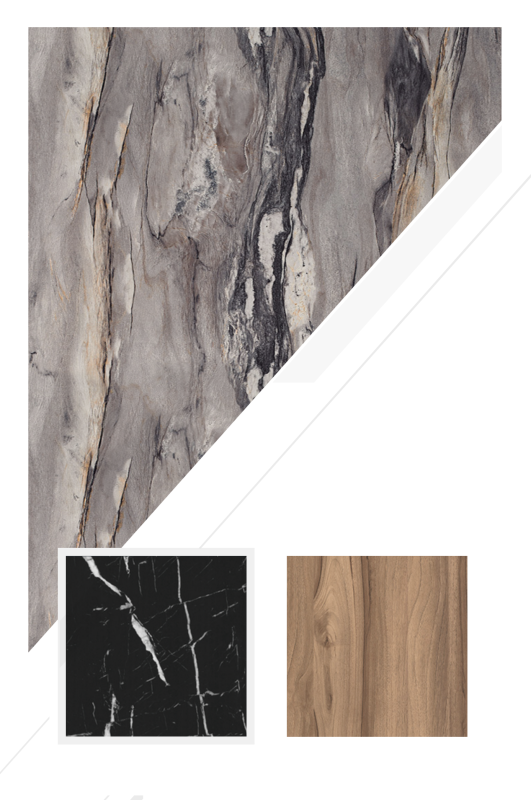

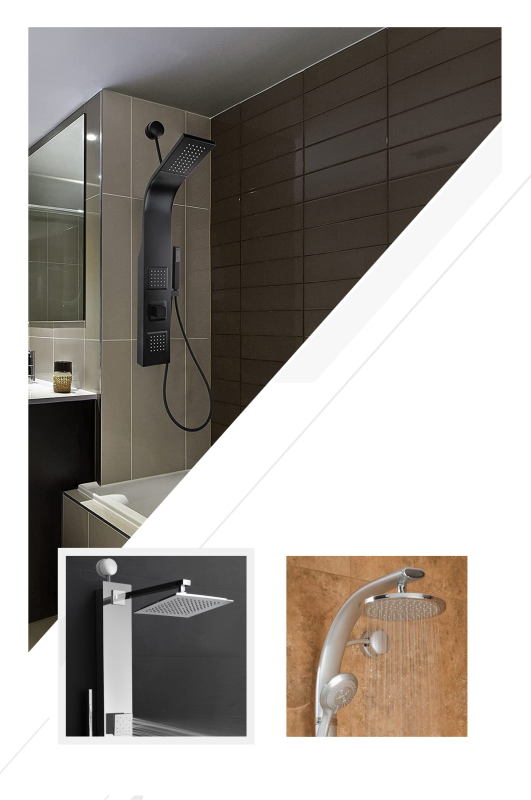

Before choosing a loan or funding option, it helps to understand how modular home and ADU costs are structured. Unlike traditional construction, modular homes are built in controlled factory settings, allowing for predictable timelines and fewer hidden expenses. Most total project costs include design, site work, permitting, foundation, delivery, and final installation.

For a small ADU or compact modular home, costs can range from around $200,000 to $350,000, depending on finishes, location, and local requirements. Because of the efficiency of the modular process, many homeowners find that their budget stretches further while maintaining high quality.

Financing Options for Modular Homes

Modular home buyers can explore several financing options depending on their financial goals and ownership plans. The most common include construction loans, permanent mortgages, and home equity loans. Some lenders even offer hybrid options designed specifically for modular builds.

Construction-to-Permanent Loans: This popular option starts as a short-term construction loan, covering the build process. Once the home is complete, it automatically converts into a standard mortgage, simplifying payments and reducing closing costs.

Modular Home Mortgages: Many lenders now recognize modular homes as standard housing, making it easier to secure long-term financing. These loans typically carry similar rates and terms to conventional mortgages, provided the home meets building code and foundation requirements.

Home Equity Loans or HELOCs: If you already own property, you can tap into your home’s equity to finance your modular project. This can be ideal for adding an ADU, expanding an existing structure, or building on a secondary lot.

Financing Options for ADUs

Accessory Dwelling Units (ADUs) have become increasingly popular as a way to generate rental income or create private living space for family members. Thankfully, several new financing programs have been designed to make ADUs more accessible.

ADU-Specific Loan Programs: Some California cities and lenders offer dedicated programs for ADUs, including low-interest construction loans and flexible credit requirements. These programs are often supported by local housing initiatives encouraging sustainable and affordable development.

Cash-Out Refinancing: Homeowners can refinance their existing mortgage and use the equity difference to fund their ADU project. This option can lower overall monthly payments and provide enough capital for construction without taking on an additional loan.

FHA and Fannie Mae Programs: Certain federal programs now recognize ADUs as part of a property’s value, allowing buyers to include the cost of ADU construction in their primary mortgage. These options can streamline financing for new homeowners planning to add a secondary unit right away.

How the Modular Loan Process Works

Financing a modular home follows a slightly different timeline than traditional builds. Since modular components are fabricated off-site, lenders often release funds in stages known as “draws.” These draws align with construction milestones such as design approval, factory build, delivery, and installation.

Joy Line Homes provides transparent documentation at every step to help homeowners and lenders track progress. This clarity gives banks confidence while helping homeowners stay on budget. Once the project is complete, the loan typically transitions into a permanent mortgage or standard repayment plan.

Preparing for the Financing Process

Before applying for a modular or ADU loan, it helps to prepare a clear budget and gather key documentation. Lenders will want to see income statements, credit reports, property details, and a construction plan with cost estimates. Joy Line Homes assists homeowners with the planning materials that make the loan process smoother and more efficient.

Understanding your financing early in the design phase also helps you make informed decisions about size, finishes, and site work. Clear financial planning ensures the project moves forward without unnecessary stress or surprise expenses.

Benefits of Financing a Modular or ADU Project

Choosing to finance a modular or ADU build allows homeowners to leverage their investment while maintaining cash flow. With predictable construction schedules and strong resale potential, these homes are among the most secure housing investments available today.

Financing spreads the cost over time, helping families build equity through long-term ownership. For those using an ADU as a rental, monthly income can often offset loan payments, creating an immediate return on investment.

Common Questions from Homeowners

Can I get a traditional mortgage for a modular home? Yes, as long as the home is placed on a permanent foundation and meets local building codes. Joy Line Homes provides all required documentation for lender approval.

Is financing easier for modular homes than for site-built homes? In many cases, yes. The fixed construction process and reduced build time make modular projects attractive to lenders, as they carry less uncertainty and lower risk.

Can I finance upgrades or energy-efficient features? Absolutely. Many lenders allow you to include upgrades such as solar panels, premium finishes, or high-efficiency systems within the loan amount, maximizing long-term value.

Working with Joy Line Homes

Joy Line Homes collaborates with trusted lenders experienced in modular and ADU financing. Their team helps homeowners prepare documentation, plan budgets, and navigate approvals. With transparent pricing and a predictable building process, financing a modular project becomes straightforward and stress-free.

From initial consultation to final installation, Joy Line Homes provides the guidance homeowners need to move confidently through the financing process. Whether it’s a small backyard ADU or a full-scale modular home, every project begins with clarity and ends with comfort and pride.

Conclusion

Financing your modular or ADU project is one of the most important steps in achieving your housing goals. With flexible loan options, predictable timelines, and experienced guidance from Joy Line Homes, homeowners can turn their vision into reality. Smart planning today leads to lasting value tomorrow, and your next chapter begins with the right financing strategy.

About Joy Line Homes

Joy Line Homes builds modular and ADU residences across California, helping homeowners achieve affordable, efficient, and sustainable living through precision design and transparent pricing.

Visit JoyLineHomes.com to explore financing and design options for your next project.

Based in Santa Clara County

Tel: (831) 888-Home

Email: info@joylinehomes.com

Business Hours: 9am - 6pm